Starting a business is a big step, and choosing the right bank account to manage your finances is just as important. A solid business bank account can help you stay organized, track expenses, and manage cash flow with ease. But with so many options available, how do you know which one is right for you?

Whether you're a freelancer, a small startup, or a growing enterprise, the best business bank account can make your life easier by offering the features you need at a price you can afford. Let’s dive into what makes an ideal business account and how to pick the best one.

What to Look for in a Business Bank Account?

Before diving into the list of the best business bank accounts, it’s important to understand the key features to look for when comparing different options. While every business has unique needs, there are a few general factors that you should consider when choosing a business bank account.

Fees:

Review the fee schedule closely, including monthly fees, transaction fees, wire transfer fees, and ATM withdrawal fees. Some accounts have fee waiver provisions if you keep a balance or have specified transaction levels, so it's essential to calculate all the expenses involved.

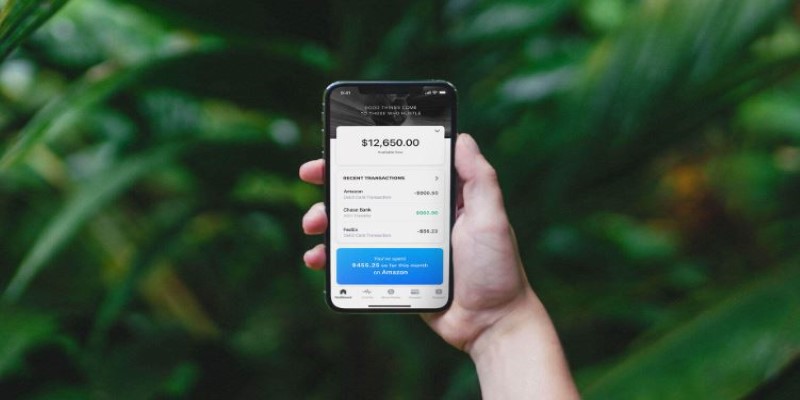

Online and Mobile Banking:

In the digital age, smooth online and mobile banking is a must. Opt for an account that has a friendly app, bill pay, and simple access to statements and financial reports so that you can handle your business money at any time and from any place.

Customer Support:

Dependable customer support is essential for business operators. Choose a bank that has specialized business banking assistance and an accessible location when you require assistance. Rapid resolution of problems can spare precious time and keep your business operating smoothly.

Additional Services and Features:

Search for business accounts with additional features such as employee debit cards, expense monitoring, and connections to accounting programs. Access to business loans or credit cards is also included in some accounts, which can assist your business while it grows.

Best Business Bank Accounts in 2025

Selecting the right business bank account can significantly affect how you manage your finances and grow your business. Here are some of the top choices for 2025, offering a range of features tailored to different business needs.

Chase Business Complete Banking

Chase Business Complete Banking is an excellent choice for businesses of all sizes, offering flexibility and convenience. With a strong reputation for customer service, Chase provides user-friendly online and mobile banking platforms. One of the standout features is the ability to waive the monthly service fee by maintaining a balance of $2,000 or making purchases with the Chase Ink Business card.

Additionally, Chase offers free ACH transfers, which can be a significant cost-saver for businesses that frequently send or receive payments. This account integrates seamlessly with popular accounting software like QuickBooks, simplifying tracking and managing your business finances efficiently.

BlueVine Business Checking

BlueVine Business Checking is ideal for businesses seeking a no-fee account with high-interest benefits. This online-only bank offers free checking with no monthly maintenance fee and allows businesses to earn a 2.0% APY on balances of at least $1,000, significantly higher than most traditional banks. In addition to free incoming wire transfers, BlueVine offers easy online bill payments, check writing, and deposits. Their intuitive mobile app ensures that business owners can manage finances on the go. BlueVine is a top choice for small businesses, freelancers, and startups, particularly for those focused on minimizing fees and maximizing interest earnings.

Novo Business Checking

Novo is a mobile-first bank that offers a simple, transparent business checking account with no monthly fees and no minimum balance requirements. This account is ideal for businesses that want a straightforward, hassle-free banking experience. Novo offers free ACH transfers, bill pay, and incoming wires, which is a great benefit for businesses that need to manage payments on a regular basis.

Novo also integrates with popular business tools like QuickBooks, Xero, and Stripe, which can save time and help streamline accounting and payments. Their mobile app is highly rated, making it easy to manage your business finances from anywhere.

Wells Fargo Business Choice Checking

Wells Fargo offers a business checking account designed for small—to medium-sized businesses. The Business Choice Checking account allows businesses to link multiple accounts, which can help them track different revenue streams. The monthly service fee is $14, but it can be waived by maintaining a balance of $7,500 or more or by making 10 or more transactions per month.

Wells Fargo offers 24/7 customer support and has a strong physical presence with thousands of branches and ATMs nationwide, which is an advantage for businesses that need in-person banking services. This account also comes with access to additional services like business credit cards, loans, and merchant services.

Axos Bank Basic Business Checking

Axos Bank offers a Basic Business Checking account that is best suited for businesses that don't need many physical banking services. With no monthly maintenance fees and unlimited domestic ATM fee reimbursements, this account offers excellent value for small businesses. Axos provides unlimited check deposits, a feature that many businesses find essential, and offers free online bill pay.

One of the benefits of banking with Axos is their commitment to fully online banking. They offer a streamlined process for managing payments, tracking expenses, and making transfers, all from their intuitive mobile and online platforms.

Conclusion

In 2025, there will be many business bank accounts tailored to different business needs. Whether you're a freelancer, startup, or established company, choosing the right account is crucial for your financial health. Key factors like fees, online banking features, customer support, and additional services should guide your decision. By carefully evaluating these elements and comparing options, you'll find the account that suits your goals. The right business bank account will streamline financial management, save time, and provide features that support your business's growth and success.